来源:四大新鲜事儿

据Bloomberg Tax2024年8月22日报道, 特朗普媒体前审计机构 BF Borgers CPA PC的 创始人 Benjamin Borgers 的注册会计师执照有被吊销的风险。 这一惩罚将使他的公司BF Borgers CPA PC无法进行外部审计或某些复杂的纳税申报。

科罗拉多州监管机构部发言人表示,科罗拉多州会计监管机构2024年8月21日 投票决定将该公司及其创始人Benjamin Borgers移交给该州总检察长,要求吊销其注册会计师执照。委员会表示, Borgers 也可能主动申请注销执照。

该公司突如其来的停业让数十家规模较小的上市公司争先恐后地寻找新的审计师,以满足监管部门的申报期限要求。

该委员会今年3月因Borgers的退休计划审计存在缺陷而对其处以5,000美元的罚款。 Borgers 没有立即回应置评请求。

该公司曾是美国最多产的审计公司之一。其客户名单上的大多数公司(超过80%)都在场外交易, 但该公司庞大的业务量使 Borgers 在拥有公众公司客户最多的审计公司名单上排名第八。 研究公司Ideagen Audit Analytics的数据显示,该公司的客户数量仅比中档公司BDO USA PC少9家。

该州监管机构部发言人说, 如果 Borgers 不放弃注册会计师资格,州总检察长将对他提出指控,他将面临行政法官的听证。

Bloomberg Tax的报道还表示,下期将披露相关细节。

美国证券交易委员会今年5月称这家总部位于科罗拉多州莱克伍德的公司是一家 「虚假审计工厂」,随着其客户群的激增, 该公司不断提供伪造的工作文件和复制粘贴的审计报告。 该公司最著名的客户是Donald Trump的社交媒体公司。SEC 永久暂停该公司的会计师执业资格。 为平息指控,该公司共支付了1400万美元的罚款,并不得不放弃对上市公司的审计。

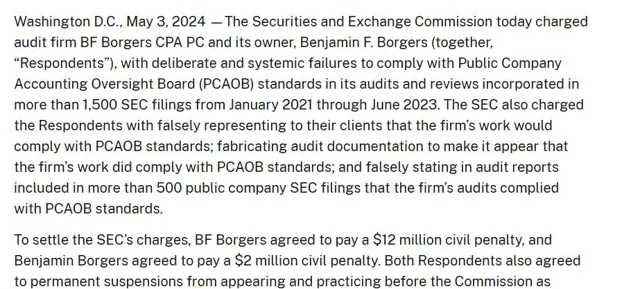

SEC指控BF Borgers CPA PC及其所有者Benjamin F. Borgers在2021年1月至2023年6月期间向 SEC 提交的1,500多份文件所涉及的审计和审查业务存在故意、系统性地未能遵守上市公司会计监督委员会( PCAOB )标准的行为。

据当时的公告, 在Benjamin Borgers的指示下,BF Borgers员工为其客户复制了之前业务的工作底稿,仅更改了相关日期,然后将其作为当前审计期间的工作底稿传递出去。 因此,BF Borgers的工作底稿错误地记录了尚未完成的工作。除其他事项外,这些工作底稿定期记录了所谓的规划会议,实际上这些会议从未发生过。

Bloomberg Tax报道 原文如下:

Colorado board refers BF Borgers to state attorney general

Sanctioned by SEC in May, firm’s largest client was Trump Media

The founder of an audit firm that was branded as a 「massive fraud」 by the SEC risks losing his certified public accounting license, a punishment that would prevent his firm, BF Borgers CPA PC, from performing external audits or certain complex tax returns.

Colorado accounting regulators on Wednesday voted to refer the firm and its founder, Benjamin Borgers, to the state’s attorney general for CPA revocation, a spokesperson for the state’s Department of Regulatory Agencies said. Borgers may also voluntarily surrender his license, the board said.

The potential sanctions follow the Securities and Exchange Commission in May calling the Lakewood, Colo.-based firm a 「sham audit mill」 that churned out falsified work papers and copy-and-paste audits as its client base surged. The firm, whose most prominent client was Donald Trump’s social media company, paid a total of $14 million in fines to settle the charges and had to quit auditing public companies.

The sudden shutdown left scores of mostly smaller public companies scrambling to find new auditors to meet regulatory filing deadlines.

The Colorado Board of Accountancy, which regulates CPA firms and doles out fines for violations, cited state statutes requiring disciplinary action if a federal agency charges a license holder with improper conduct or willful violation of rules. The board in March fined Borgers $5,000 for flawed retirement plan audits. Borgers didn’t immediately respond to a request for comment.

The firm had been one of the most prolific auditors in the US. The majority of companies on its roster—more than 80%—traded over the counter but the sheer volume of the firm’s business made Borgers rank No. 8 on a list of audit firms with the most publicly traded clients. It had just nine fewer clients than mid-tier firm BDO USA PC, according to research firm Ideagen Audit Analytics.

If Borgers does not relinquish his CPA, the state’s attorney general will file a notice of charges against him and he would face a hearing in front of an administrative law judge, the spokesperson for the state’s Department of Regulatory Agencies said.

(Updates starting in paragraph two to include details on process. )

(转自:四大新鲜事儿)